ASSET-BACKED

BENEFITS

Loan tenure up to 10 years

Extensive experience in the automotive value chain

Financing up to 80%

GIRO payments available for your convenience

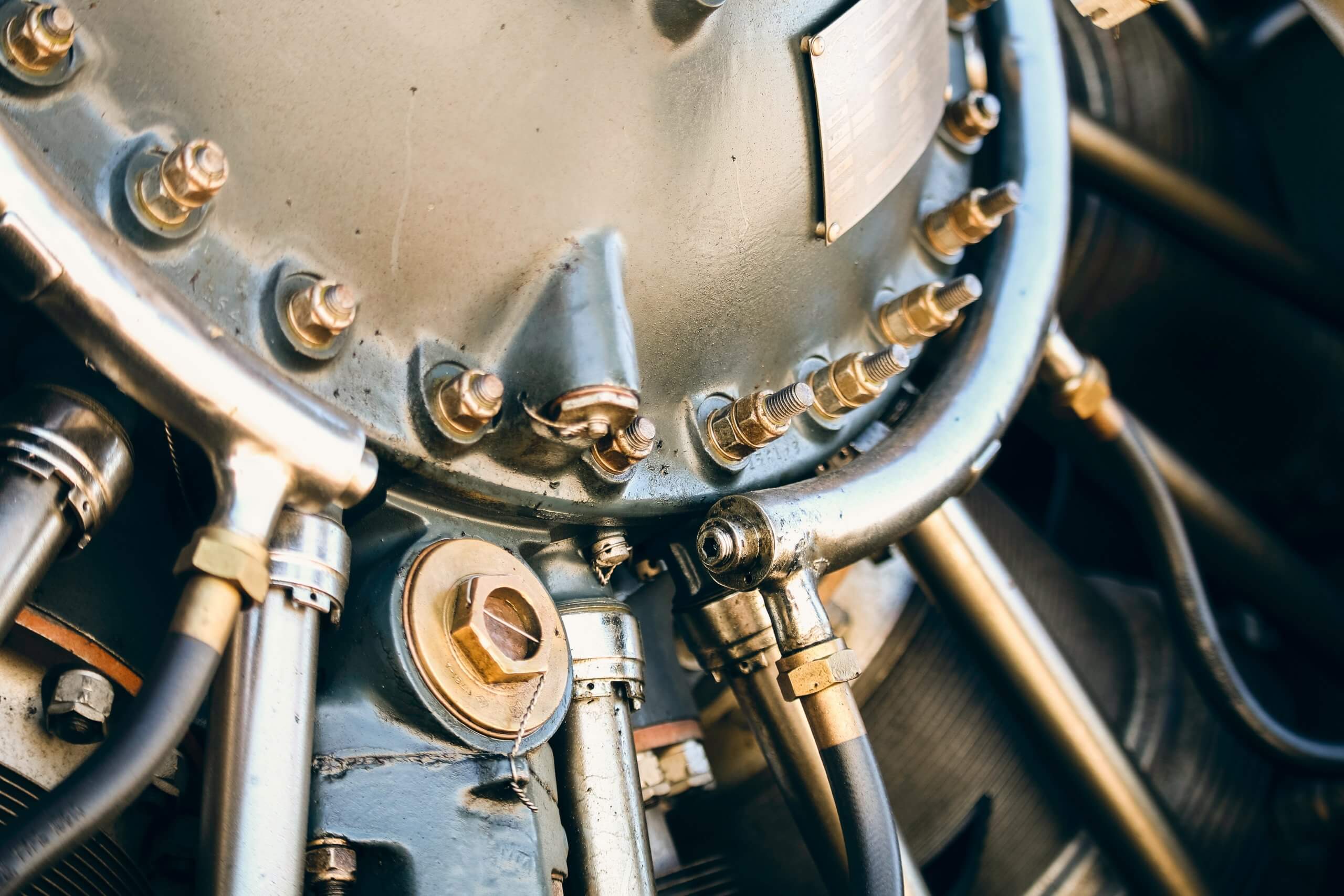

EQUIPMENT

When you start up a new business, assets such as office equipment, machinery and more are required. Having these can help boost business growth and efficiency. However, it will need a large sum of capital to get what you need.

Equipment financing can assist you whenever you do not have enough cash to purchase the equipment. Whether new or used, the equipment will serve as collateral for the loan. After the instalments have been paid to fulfil the loan, the equipment will then be owned by you.

An equipment loan is a fast and easy way to finance the purchase of the business equipment that you need. It will help you kickstart your growth and generate more revenue for your business.

PROPERTY

Tight cash flow can be a barrier to grow your business. With current costs such as operations, salaries and more, your business growth may be postponed if you do not have enough capital.

With GBFS's property-backed secured loans, tight cash flow is no longer a problem. By using your property as collateral, whether private residential, retail or office, we can provide you with additional cash flow to eliminate your short-term financial needs. As your business growth is our priority, we provide flexible repayments such as interest servicing and bullet payment so you can focus on what matters most.

STEPS (PROCESS FLOW)

Get in Touch

- Have an idea of how much you need & provide your information in just less than 10 minutes

Review Your Loan Options

- Our team will reach out within 24 hours to work with you in customizing the best financing options

Receive Funds

- Once approved, loans are disperse as quick as within 24 hours